- Bank nifty, or nifty bank, is the index of the National Stock Exchange (NSE).

- It is the index of banking stocks.

- This index is an Indian stock index that has the distinction of being the most frequently traded indices in the market for futures and options in the entire banking sector.

What is a nifty bank?

- Bank nifty is the index of banking stocks.

- If you wish to enter the world of stock investing, then you can use the bank nifty option to determine which stock to select.

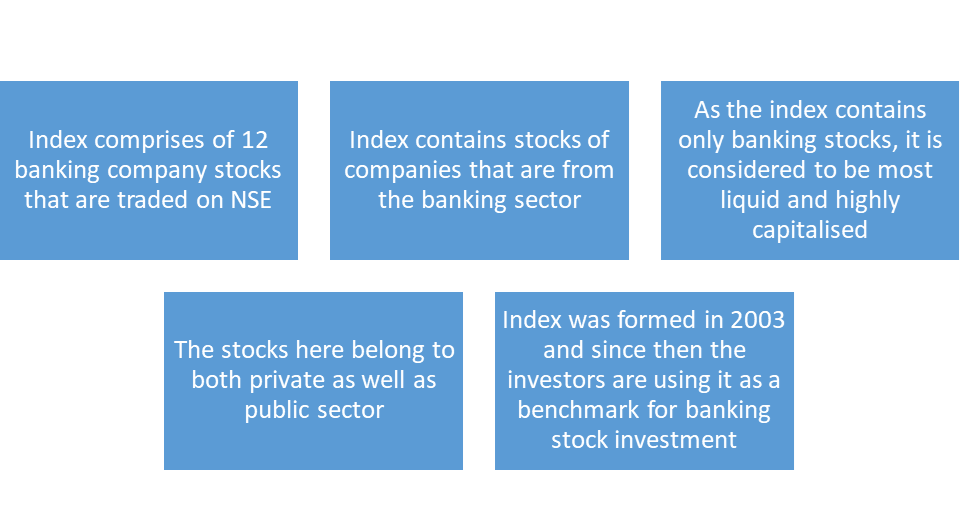

Some of the key information about the bank nifty index is as follows

How is the bank nifty index used?

- For the best investment plans, it is very essential to understand the workings of the bank nifty index.

- Bank nifty sets a useful index for evaluating direct shares, banking industry IPOs, and mutual funds.

- This index also provides a comprehensive view of the banking sector with the larger capital market and is important for both experts and individual investors due to its weighted nature.

- Bank Nifty also provides a variety of functions, such as providing fresh ETFs as well as insights on other index funds while benchmarking fund portfolios.

- As a result of this, investors have more freedom to research intricate financial items and increase their knowledge.

- Though they were introduced in 2003, the calculations are still based on the year 2000.

- NSE offers real-time updates throughout regular trading hours, thereby giving investors the ability to make timely decisions.

You can also read: Nifty: How It is Calculated and List of Top 10 Companies

Which sectors are covered by Nifty?

The Nifty includes stocks from all the important sectors of the economy.

The following is the sectoral breakdown in Nifty:

| Sr. No. | Sector | Sector Distribution (%) |

| 1 | Financial services | 35.95 |

| 2 | Information technology | 13.77 |

| 3 | Oil, gas, consumables & fuels | 11.24 |

| 4 | Fast moving consumer goods (FMCG) | 9.29 |

| 5 | Automobile & auto components | 6.21 |

| 6 | Construction | 4.24 |

| 7 | Healthcare | 4.12 |

| 8 | Metals & mining | 3.81 |

| 9 | Consumer durables | 3.18 |

| 10 | Telecommunications | 2.71 |

| 11 | Power | 2.41 |

| 12 | Construction materials | 1.94 |

| 13 | Services | 0.77 |

Uses of Bank Nifty

The bank nifty index can be used for two main purposes.

They are as follows:

Index as a benchmark:

- The Bank Nifty Index is regularly used as a standard by mutual fund managers and investors.

- This index as a benchmark will inform investors on how banking stocks will perform in general and whether certain funds are likely to make gains.

- The main aim of investors using bank nifty is to surpass bank nifty returns.

- So, if a fund has exceeded the returns of the bank nifty index, you should consider that fund as a positive investment.

Index for options trading:

- This index confirms returns within the range of 2–3%.

- With this knowledge, investors can invest or trade in various options trading strategies based on bank nifty options.

- This index will also leverage its historical performance data to make informed trading decisions.

Nifty bank companies:

- Nifty Bank consists of 12 banking sector companies.

- The stocks of the 12 banking companies that are listed in this index are made up of well-known names in the banking and finance sectors.

- The top-notch stocks listed in the bank nifty are as follows:

| Sr. No. | Stock Name | Stock Price |

| 1 | HDFC Bank Limited | 1483.00 |

| 2 | ICICI Bank Limited | 1121.65 |

| 3 | Kotak Mahindra Bank Limited | 1647.35 |

| 4 | Axis Bank Limited | 1128.95 |

| 5 | State Bank of India | 810.55 |

| 6 | IndusInd Bank Limited | 1442.65 |

| 7 | Bank of Baroda | 262.40 |

| 8 | Federal Bank | 157.35 |

| 9 | AU Small Finance Bank Limited | 625.70 |

| 10 | IDFC First Bank | 77.10 |

| 11 | Punjab National Bank | 124.55 |

| 12 | Bandhan Bank Limited | 180.00 |

Technical analysis with Bank nifty

- The bank nifty index is the contrast of the nifty 50 stocks and consists of the stocks that are from the banking sector.

- When the investors are planning to invest in the banking sector alone, they can then use technical analysis that is based on the bank nifty to gauge the performance.

- It is always crucial for any investor to invest or trade, and so technical analysis will provide investors with ways to analyze trends, identify patterns, and evaluate the consistency and strength of the trends.

- Charts with data for the bank nifty are available for investors with different timeframes.

- Multiple timeframes, such as daily, weekly, monthly, and quarterly, are available for investors to analyze the performance of the banking stocks.

Conclusion

The banking and finance sector is the most widely used and highly invested sector in our country.

Frequently Asked Questions (FAQs):

Q1) What is bank nifty?

The Bank Nifty is an index comprising 12 banking company stocks.

Q2) Who controls Bank Nifty?

Bank Nifty is controlled by NSE Indices Limited, or IISL.

Q3) Which bank nifty is the best?

The most common and widely traded bank nifty stocks are HDFC Bank, ICICI Bank, SBI, Kotak Mahindra Bank, and Axis Bank.

Q4) What is the symbol of the bank nifty?

The symbol of Bank Nifty is CNXBAN.

Q5) What is the full form of nifty?

The full form of nifty is National Stock Exchange FIFTY.

About Us:

Nifty Trading Academy is our institute, where we provide the entire knowledge and study form of the stock market as well as technical analysis. We also provide live market trading sessions and online learning. We also upload blogs for technical analysis and stock market learning.