Low Price Stocks

having low price stocks is the advantage of costing less than high price stocks, but they have a tendency to be more volatile.

Stocks with a price less than 1$ a share are known as “penny stocks” but this basket also includes stock prices under 5$.

Penny Stocks are highly risky, but some of them also have the potential of turning a small investment into a fortune. They are such, which do not attract lot of attention during the majority of trading days. Hence their volumes can be very low. Due to low volumes, these types of stocks are prone to price fluctuations. These price fluctuations can make or break the investment because rapid price fluctuations in penny stocks may be “influenced”.

The volatility of Low price stocks

Volatility is a measure of dispersion around the average or mean return of a security. Low price stocks are not for the faint. They can potentially double or even triple in a single day. For the same time period, they can cut in half or wiped out altogether.

Risk

Thousands of stocks are actively traded in global markets, stocks with low price and low volumes are trade irregularly. In addition, type of stocks having low volume are harder to buy and sell quickly at the market price. Sometimes a stock is priced low because it has been falling for some time, which makes it a far riskier investment.

Learn – How to Invest in Stock Market

Growth v/s Value

Investors are willing to drive up the price for the stock because they believe the company has good growth prospects. If a company has a lower P/E, investors get more earnings for their investment at low price, but it can also simply indicate that investors aren’t very confident about the company’s prospects.

High Price Stocks

Many investors assume that a stock with small price is cheap, and stock with higher price is expensive. There is a common saying – “Don’t judge a stock by its share price.” It despite much readily available information for investors. Assumptions of many investors for low and high price stocks can lead them to the wrong path and may be into some bad decisions for their money. The high-priced stocks can be great wealth-building fuel for the Investors.

Volatility

Stocks that trade for more than a 100$ are often ignored, thus that reduces the level of volatility for that particular stock. Many of the fluctuations that are associated with trading do not affect high-priced stocks as many of the investors are long-term investors.

Risk

Financially sound companies will usually have a high stock price and they are more likely to hold their value and steadily appreciate over time, that makes it a less risky investment.

Growth stocks are associated with high-quality, successful companies whose earnings are expected to continue growing. These types of stocks have generally have a price to earnings ratio.

If a company has a high P/E ratio, investors are paying a higher price for the stock compared to its earnings. Investors are willing to drive up the price for the stock as the belief that the company has good growth prospects.

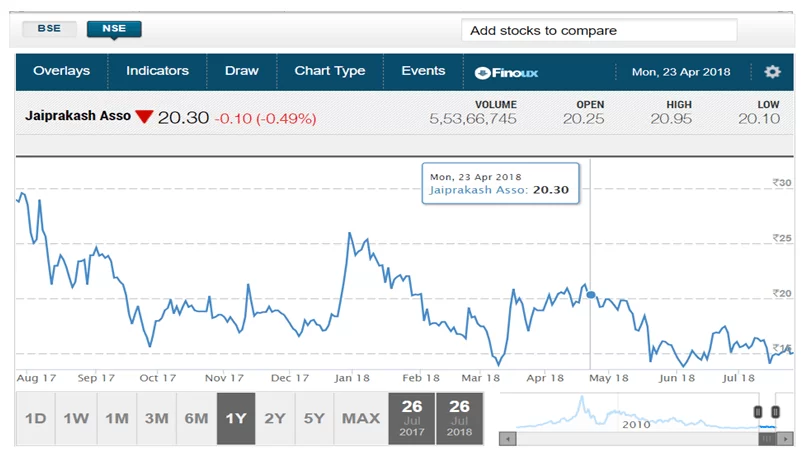

Example No. 1

- Jaiprakash asso.

- Price on August 2017 – 25 Rs/-

- Price on July 2018 – 15 Rs/-

- Price on Nov. 2021 - 10.40 Rs/-

- Jaiprakash asso. Which was trading at over 25 Rs/- in the year 2010 reduced at 15 Rs/- in the year 2018 and also 10 Rs/- in 2021.

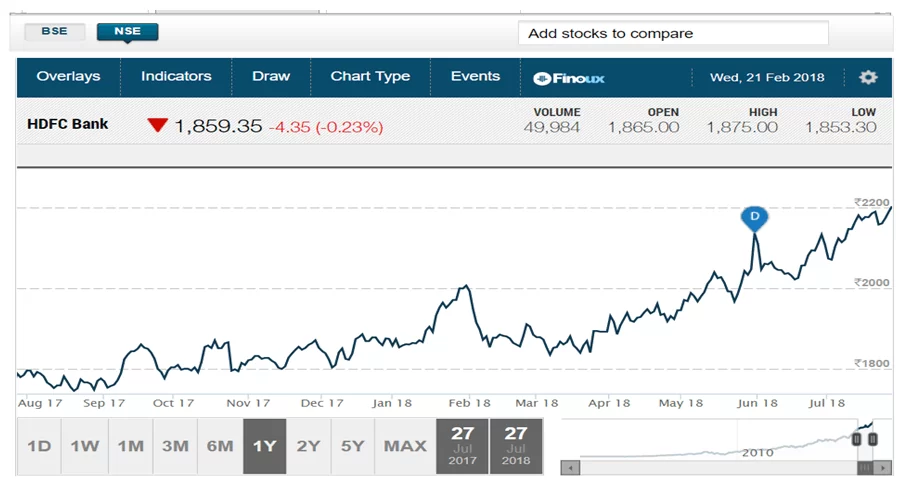

Example No. 2

- HDFC Bank

- Price on August 2017 – 1780 Rs/-

- Price on July 2018 – 2200 Rs/-

- Price on Nov. 2021 – 1525 Rs/-

- HDFC Bank which was trading at over 1780 Rs/- in the year 2017 that gives high return on investment and traded at 2200 RS/-.

On the basis of statistical data – stocks priced higher than Rs. 500 deliver higher returns both over short and long term in comparison to stocks priced below 500 Rs.

Get List of Best Stocks for Long Term Invest