- In today’s world, investing in the international stock markets has become more accessible and appealing.

- With technological advancements, seamless global communication, and the increasing interconnectedness of the economies, international stock markets are offering a wide range of opportunities for diversifying the investment portfolio.

Understanding International Stock Markets

- International stock markets refer to the exchanges where investors from different countries will buy and sell securities such as stocks and bonds.

- These markets are existing worldwide, including the renowned financial centers such as the New York Stock Exchange (NYSE), London Stock Exchange (LSE), Tokyo Stock Exchange (TSE), and many more.

- Investing in the international stock markets will provide several advantages to the investors.

- More importantly, it will allow the portfolio diversification.

- By investing in different regions, industries, and currencies, investors will spread their risk and also potentially reduce the impact of localized economic downturns.

- Additionally, international markets will often provide exposure to the sectors and the companies that are not available in the domestic markets.

- They also offer unique investment opportunities.

Benefits of investing in the international stock markets

Investing in the international stock markets will provide a huge range of benefits.

Some of the main benefits are as follows:

Diversification

- Investing in the international stocks will help to mitigate the risks by diversifying across various economies, industries, and currencies.

- This diversification will potentially lead to a more stable portfolio and will also reduce the impact of economic fluctuations in any country or region.

Access to new opportunities

- International stock markets will be providing access to the companies and industries that might be experiencing rapid growth and technological advancements.

- This will also offer the investors the chance to participate in their success.

- Emerging markets can offer significant growth potential as developing economies expand.

Currency appreciation

- Investing in international stocks will provide exposure to different currencies.

- If a local currency appreciates relative to an investor’s home currency, it will result in additional returns when converting foreign investments back into the currency of the investor.

Hedging against domestic risks

- By diversifying across different countries, investors will be able to hedge against potential risks and uncertainties that are specific to their domestic market.

- Some of the main considerations here are potential instability, regulatory changes, and the economic downturns.

Challenges and considerations of investing in international stock markets

- Investing in the international stock markets will pose numerous benefits.

- But it also comes with its own challenges and considerations.

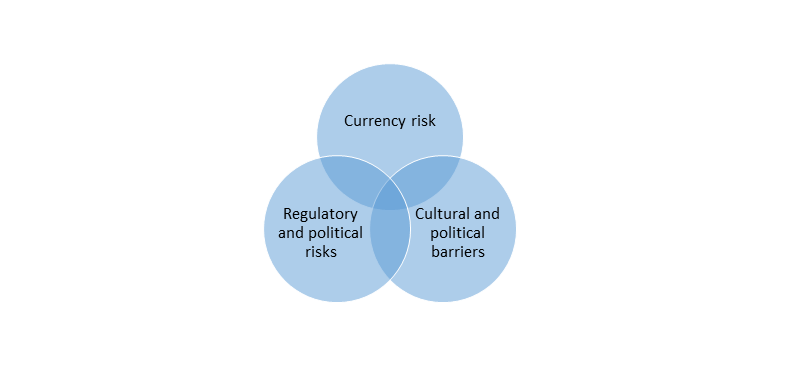

Some of the main challenges are as follows:

Currency risk

- Fluctuations in the exchange rates will impact the investment returns.

- A strong local currency will erode the value of the gains when converted back to the currency of the investor.

- Conversely, a weal local currency might enhance the returns when converting back.

Regulatory and political risks

- Different countries have varying regulatory frameworks, political stability, and investor protection measures.

- Investors should carefully consider the legal and political environment of the foreign market where they plan to invest.

Cultural and political barriers

- Investing in the international market will involve navigating cultural and language differences.

- This can present the challenges in understanding the financial reports, communicating with the companies, and staying updated on the market developments.

Strategies for investing in the international stock markets

- You should surely consider investing in the international stock markets.

- For such investment, you should consider some of the main strategies for the same.

Some of the main strategies for investing in the international stock markets are as follows:

Research and due diligence

- Thorough research and understanding the target economy of the country, political landscape, regulatory framework, and cultural factors are very crucial.

- Also, studying the performance and the financials of the individual companies before investing is vital to making informed decisions.

Diversify across regions

- Instead of focusing on a single foreign market, you should consider diversifying investments across different countries and regions.

- This approach will also help to reduce the impact of the localized risks and also enhance portfolio stability.

Consider Exchange Traded Funds (ETFs)

- ETFs will provide a convenient way to gain exposure to the international markets.

- They will track specific indices or sectors in various countries.

- This will offer instant diversification and liquidity.

Conclusion

Investing in the international stock market will offer a wide range of benefits as well as challenges.

Frequently Asked Questions (FAQs)

Q1) Where to invest during a bull market

During the bull market, you should invest in the companies with a history of growth.

Q2) Why do investors invest in the international markets?

International stocks are cheaper, pay higher dividends, and also have valuations below their historical average.

Q3) Who is the big bull in the stock market?

Rakesh Jhunjhunwala is the big bull in the stock market.

Q4) How to invest in the global markets?

For investing in the global markets, you should open an overseas trading account.

Q5) Which trading strategy is the most successful?

Trend trading is the most successful trading strategy.

About Us

Nifty Trading Academy is our academy where we teach you about the stock market as well as technical analysis. We also provide live trading sessions and upload blogs for the same.