- Risk management is one of the most important pillars for successful trading.

- Without proper risk management in trading, no trader will be able to make consistent profits for a long period of time.

- Without risk management, there are high chances that the trader may end up blowing all their capital even if they have the best trading strategy.

Concept of risk management in trading

- Every trader will take some amount of risk for every rupee reward that he earns.

- Risk management is how a trader will manage that risk and come out with a profitable series of trades.

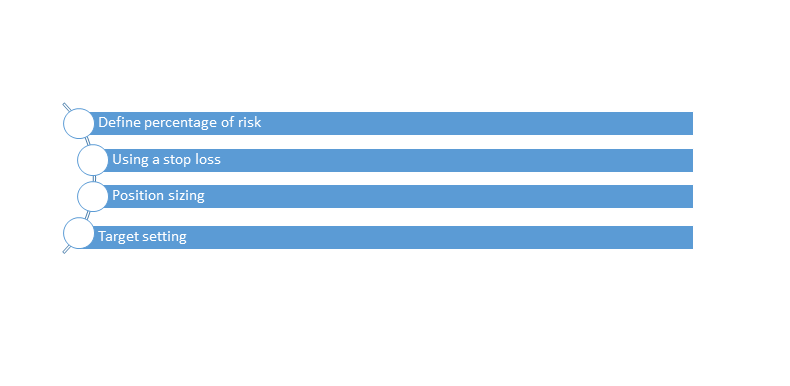

Principles of risk management in trading

- There are several risk management principles that you should apply while trading so as to make consistent and long-lasting profits.

- Every trader should adhere to certain fundamental rules.

The following are those rules:

Define the percentage of risk

- You should not lose more than a specific percentage of the amount.

- This is considered to be the most fundamental as well as the most effective way to control your losses as a trader.

- Also, to become a profitable trader, you should cut your losing trades and hold onto the winning trades.

- Once your risk is determined, you will work on eliminating the possibility of a big loss, and this is how you will win in the long run.

Using a stop loss

- Whenever you will place a trade, it is also mandatory to place a stop loss.

- Without stop loss, trading is like a vehicle with failed brakes, which can crash at any point in time.

- Stop loss will save you from a huge loss that can also blow your trading account in a single trade.

- In trading, being worst is not a mistake, but staying wrong is a huge mistake.

- So, when your stop loss will get hit, you should always accept that stop loss without any particular emotional barrier.

- Some of the traders will place the stop loss in a system, and others will place the same in their minds.

- So, when they see their stop loss hitting, they will exit the trade without any sort of hesitation.

- If you are a new trader, you should always place a stop loss in the trade.

Position sizing

- Position sizing is nothing but the quantities of the shares or contracts you would wish to trade.

- Position sizing is based on the amount of the stop loss and the amount of the capital that you wish to risk in a particular trade.

- The formula for position sizing is risk per trade * amount/stop loss value.

Target setting

- In trading, we will make the money at the exit.

- So, it is very important to know the best time to exit the trade.

- In order to be a successful trader, you should know where to place your stop-loss order as well as target logically.

- Also, you can use the concept of trailing stop-loss orders so that you can manage your risk timely and then come out with some profit.

- Many of the people will not use the trailing stop loss and will then convert their winning trade into a losing one.

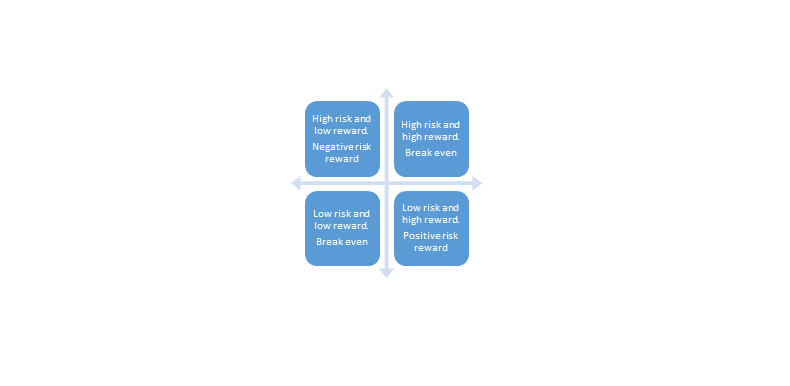

Risk-to-reward ratio

- The risk-to-reward ratio is nothing but the risk taken for every rupee earned.

- Generally, traders with a good risk-to-reward ratio such as 1:2, 1:1.5, or even 1:3 are preferred rather than the trades that will offer a bad risk-to-reward ratio.

- The reason for the same is because you will be risking more money than you will even potentially make.

- Thus, it is said that you should never take the trades with a bad risk-to-reward ratio.

- This is the most fundamental rule of risk management in trading.

- The risk-to-reward ratio is divided into 4 quadrants.

They are as follows:

Real importance of risk management in trading:

- We will understand this concept with the help of an example.

- Consider that there are two traders where one will follow some of the risk management rules, such as the 2% rule or trailing stop loss, etc., and the other one will not follow any of the risk management principles.

- Now, let us say that they are having a losing streak and consequently lose 5 to 6 trades.

- Now because of the risk management rules, the first trader will only lose 10%–12% of the account, whereas the other trader might end up blowing his entire account in just those 5–6 trades.

- This is how risk management will save you from capital erosion.

- You should not just follow the risk management rules, but you should also follow them.

Risk management techniques for options traders

- Options are high-risk and high-reward trading instruments, and so it is not easy to trade in them because they will contain a lot of risk.

- They are also quite volatile when they are compared to equity trading.

- Thus, there are some of the basic risk management principles that you are supposed to follow in options.

- Another most important thing to understand here is if you are new in trading and have not traded in equity, then you should first try equity and become a profitable trader there for a couple of months.

- Once you will become familiar there, then you should try options with 1-2 lots.

- As an options buyer, you should only use 25%–30% of your capital in a single trade.

- The most common mistake that the options trader will make here is suing their entire capital in one single trade and also trading in heavy quantities with a hope of greater profit.

- Another important rule for the options trader is to never trade out-of-the-money options.

- They are cheap and less risky, but in reality, the situation is just the other way around.

- As an option seller, you should never trade without a stop loss or a hedge.

- Option sellers will contain an unlimited risk and will also make a lot of profit by selling out-of-the-money options.

- For an option seller, the win rate is higher, and for an option buyer, your winning size is higher.

Trading psychology and risk management

- Trading psychology and risk management are two very different concepts and practices that are closely related to each other.

- To make a successful career, you are supposed to master both of them.

- Risk management is nothing but strategy development, and trading psychology is nothing but execution of that strategy with 100% efficiency.

- If you have a good risk management strategy but are also unable to follow that strategy due to improper trading psychology, then that strategy can be considered worthless.

- In order to improve your trading psychology, you should work on your mind as well as your body.

- You should also read the best trading books and other literature so that you will be able to earn from the experiences of others.

- In trading, your psychology is your weapon, and it will also play a major role in defining profitability.

Conclusion

Trading is a serious business, and so you are supposed to focus on trading psychology, risk management, and technical analysis.

Frequently Asked Questions (FAQs)

Q1) Why is risk management in the market?

Risk management will help the investors anticipate potential losses and also make informed decisions.

Q2) What is the importance of risk management in investments?

It will prevent financial losses.

Q3) What is the goal of the risk management?

The goal of risk management is to protect the assets of the organization, including its people, property, and profits.

Q4) What is risk management in the stock market?

Risk management is the process to identify the potential downsides as well as the potential rewards of an investment.

Q5) Which trading has the highest risk?

Options trading has the highest risk.

About Us

Nifty Trading Academy is our academy where we teach you about the stock market as well as technical analysis. We also provide live trading sessions and upload blogs for the same.