There are two different kinds of circuit filters used in markets: one is used at the stock level, while the other is used on a market-wide scale. It is claimed that a stock has "hit the circuit" when it makes a significant move in either direction (either up or down) or when it reaches the highest price level at which it is legally possible to trade for the day. In the event of a movement in the upward direction, the stock will contact the Upper Circuit; nevertheless, in the event of a movement in the downward direction, the stock will contact the Lower Circuit.

Understanding Circuits in The Stock Market

The stock market does not move consistently in a single direction, and the market moves in different patterns. Analysing these patterns is called "technical analysis" this technical analysis helps us to stay away from losses and helps us to generate profits.

Stock market or a particular stock may hit the circuit for many reasons, and the most prominent and common reason is the "NEWS", e.g., if there's a piece of positive news, there could be a high demand for the stock, and it may hit the upper circuit. And if the news is negative, the stock could hit a lower circuit.

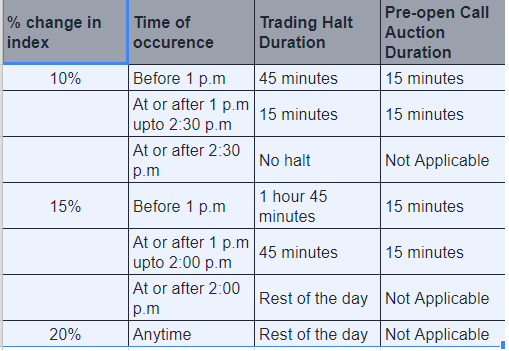

In general, the regulating body for the stock market has established the pre-defined body circuit for every stock within the range of 5 percent, 10 percent, and 20 percent. Therefore, a warning signal is generated by the circuit breaker system whenever the index experiences a drop of 10 percent, 15 percent, or 20 percent.

When this occurs, depending on the percentage of the decline, trade may be paused for a period of time. In addition, it is essential to comprehend that these circuits are not intended for particular equities but rather for the market as a whole.

The length of time that trade is halted for is determined by the magnitude of the movement as well as the moment at which it took place.

At any point in time that the stock hits a lower circuit, there will be no buyers and only sellers. In addition, whenever a stock reaches an upper circuit, there will be no sellers left to compete with the buyers. The circuit limit is adjusted every time there is a change in the price of the stock.

How To Exit from Lower Circuit Stock

If you are an investor, no matter beginner or a long-term investor, it is essential to gain a better understanding of the market. It is advisable to break free from the lower circuit stock as prolonged exposure can cause a lot of loss. The most convenient and easy way of breaking out and selling a lower circuit stock is to place an order during the pre-open session. i.e., you have to place a sell order in pre-market with the below calculation precisely at 9 am.

This is because, during the circuit break, the market works on a first-come, first-serve basis and placing the order at the earliest might help in selling the stock at the right time; thus, the pre-opening and AMO (After Market Order) help in exiting the trade even when the market hits the lower circuit.

Because the market changes so much, the lower circuit in trading is normal. It experiences a lot of ups and downs on a regular basis. According to SEBI requirements, particular breakers are assigned to keep random fluctuations and changes in check, and the lower circuit limit is also determined.

In the past years, there have been many instances when the market has crashed due to the breaching of limits. So even after a lot of research, even if you somehow get stuck in the lower circuit, then it's recommended to exit it as soon as possible, placing the sell order in advance.

Therefore, engage in strategic commerce and make the most of your efforts when trading.

If you want to learn how to trade stocks, there is no better place to start than a reputed stock market training centre Nifty Trading Academy in Maharashtra and Gujarat. You will receive expert coaching and direction on how to navigate the complicated world of financial investment at these seminars.