#1. Learn What is Zerodha ?

Zerodha is the second-largest Discount Broker in India. This broking company was established in 2010 in Bangalore and by now the company has a presence in multiple Indian cities.

Over One million clients of Zerodha are satisfied by its powerful ecosystem of investment platforms, and customer support system.

Different products of Zerodha

Zerodha offers different products and services such as software and mobile applications. The detailed information of products is given below:

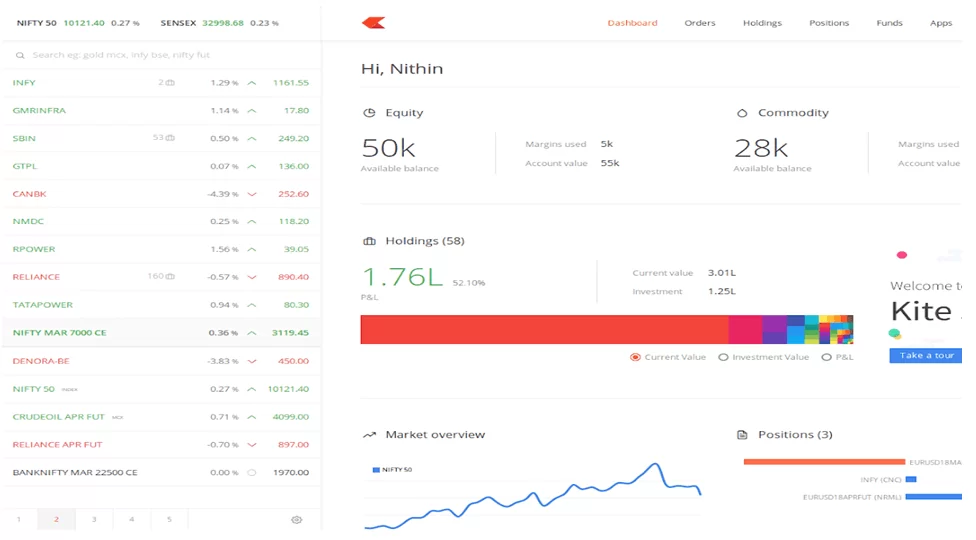

1. Kite 3.0

Kite by Zerodha is a trading platform for their clients. Here you can do technical analysis of different stocks and also you can search across 90,000+ stocks and F&O contracts among multiple exchanges instantly. You can also find your favourite stock, bonds, derivatives or metal – with absolutely zero latency.

- Kite 3.0 provides Advance level of charting with Hundreds of indicators, studies, and tools that helps you to customise your own charting interface.

- once you connect with Zerodha, their proprietary computations keep track of all your trades, transfer and other activities related with your P&L Account.

- Kite 3.0 also provides impactful data widgets, live ticks, order alerts and more.

2. Zerodha KITE Mobile App

Zerodha Mobile application help you to trading from your mobile. Features of this mobile application are:

- Multiple Market Watch. You can use this feature to monitor specific stocks across different sectors and industries.

- Here different types of charts available with customize options.

- You can perform technical analysis and fundamental analysis as per your performance.

- Also, more than 80 technical indicators and drawing tools are available for technical analysis.

- You can easily transfer and manage your funds from kite mobile application.

- With the single tap you can place buy and sell order.

- App works well at low internet band with as well.

- In this application you get option to place bracket order, cover order, positional order, stock loss market order, etc.

3. Kite Connect APIs for Programmatic Access

- Kite connect is a set of simple http APIs built on top of Zerodha exchange approved web-based trading platform.

- By using this platform, you can get programmatic access to data.

- Kite Connect help traders can place and manage orders with any programming language (i.e. Python, java, C#, etc.)

- Kite connect allows users to track and manage their own programmatic API access.

Now Learn Zerodha Margin

Margin is the difference between the total value of securities held in an investor’s account and the amount from the broker. Margin can help to amplify your profits also at the same time heighten your losses as well. Thus, you should us the margin on your trades only if you understand the risk involved with it.

Zerodha Margin calculator is first online tool in India that helps you to calculate comprehensive margin requirements for option writings/shorting or multi-leg F&O strategies while trading equity, F&O, commodity and currency before taking trade.

Zerodha Equity Margin

- Equity is one of the most popular trading segments. You can get a margin of anything in between 3 times to 20 times depending on the stock and the other type.

- And for MIS, your leverage is in the range of 3 to 10 times and the order will get auto-square off around 3:15 pm if you don’t do it by yourself manually.

- Also, there is an option available to use cover order as well, where you are required to put a stop-loss as a compulsory metric. Equity Margin can fall from 6 to 20 times.

- You can check the details on below link how much margin you get depending on the order type.

- https://zerodha.com/margin-calculator/Equity/

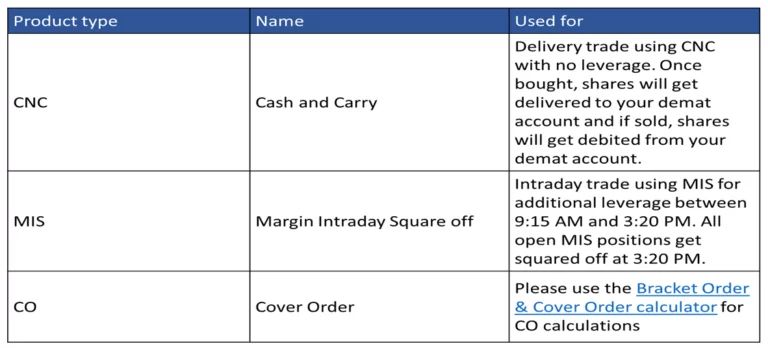

Here is the table from where you can easily understand the basic terms.

Zerodha F&O Margin

- The Zerodha margin calculator is the online tool in India that helps you to calculate comprehensive margin requirements for future and option trading.

- Margin requirement for F&O trades with F&O Margin Calculator:

- F&O NRML Margin calculator (carry forward position) – NRML is a standard product type to buy and hold future contracts. It is also used for intraday future contracts as well.

- F&O MIS Margin calculator (Intraday Trading) – It is a purely intraday product type that allows trader to buy and hold the futures contract only for one day. You cannot carry forward the position for next day.

- F&O CO/BO Margin calculator – It is a tool that helps to calculate the leverage given for trading in equity intraday and equity Future and option using Basket order (BO) and cover order (CO). You can get up to 33x margin with Zerodha CO/BO orders.

You can refer https://zerodha.com/margin-calculator/SPAN/ to get more details.

Zerodha commodity Margin

- Zerodha is among select few brokerages to not levy the additional 5% special margin and hence has the lowest margin NRML requirement for trading futures for overnight/ positional.

- Here you can check the margin for commodities.

| No. | Commodity | Lot size | Price | NRML Margin | MIS Margin |

| 1 | ALUMINI | 1 MT | 147.1 | 10002 | 5001 |

| 2 | ALUMINIUM | 5 MT | 147.1 | 50381 | 25190 |

| 3 | BRASSPHY | 1 MT | 365 | 18250 | N/A |

| 4 | CARDAMOM | 100 KGS | 1366 | 18987 | N/A |

| 5 | CASTORSEED | 110 MT | 4630 | 231500 | 115750 |

| 6 | COPPER | 1 MT | 419.65 | 28536 | 14268 |

| 7 | COPPERM | 250 KGS | 419.65 | 7092 | 3546 |

| 8 | COTTON | 25 BALES | 22850 | 28562 | N/A |

| 9 | CPO | 10 MT | 603.1 | 30155 | N/A |

| 10 | CRUDEOIL | 100 BBL | 4934 | 43419 | 21709 |

| 11 | CRUDEOILM | 10 BBL | 4934 | 4282 | 2141 |

| 12 | GOLD | 1 KGS | 30315 | 151575 | 75787 |

| 13 | GOLDGUINEA | 8 GRMS | 24109 | 1205 | 602 |

| 14 | GOLDM | 100 GRMS | 30340 | 15170 | 7585 |

| 15 | GOLDPETAL | 1 GRMS | 3035 | 151 | 75 |

| 16 | LEAD | 5 MT | 146.35 | 61393 | 30696 |

| 17 | LEADMINI | 1 MT | 146.35 | 11693 | 5846 |

| 18 | MENTHAOIL | 360 KGS | 1677.1 | 74443 | N/A |

| 19 | NATURALGAS | 1250 MMBTU | 200.7 | 15830 | 7915 |

| 20 | NICKEL | 250 KGS | 894.2 | 19404 | 9702 |

| 21 | NICKELM | 100 KGS | 893.9 | 7759 | 3879 |

| 22 | PEPPER | 1 MT | 38500 | 21714 | N/A |

| 23 | RBDPMOLEIN | 10 MT | 668 | 33400 | N/A |

| 24 | RUBBER | 1 | 13250 | 662 | 331 |

| 25 | SILVER | 30 KGS | 37035 | 55552 | 27776 |

| 26 | SILVERM | 5 KGS | 37071 | 9267 | 4633 |

| 27 | SILVERMIC | 1 KGS | 37073 | 1853 | 926 |

| 28 | ZINC | 5 MT | 174.35 | 69478 | 34739 |

| 29 | ZINCMINI | 1 MT | 174.4 | 14126 | 7063 |

Related Article – Best Formula of Intraday Trading Techniques