To learn more about the new trading strategy and doji formation that lets you profit in bull and bear markets so you grow your wealth steadily even during a recession. Though many people search about bullish candle patterns, here this article helps you to know more about the Doji Candlestick Pattern and how to come across the trading market. In the trading opportunities, most of them look for a higher frame than the lower frame.

Different Types of Doji Candlesticks

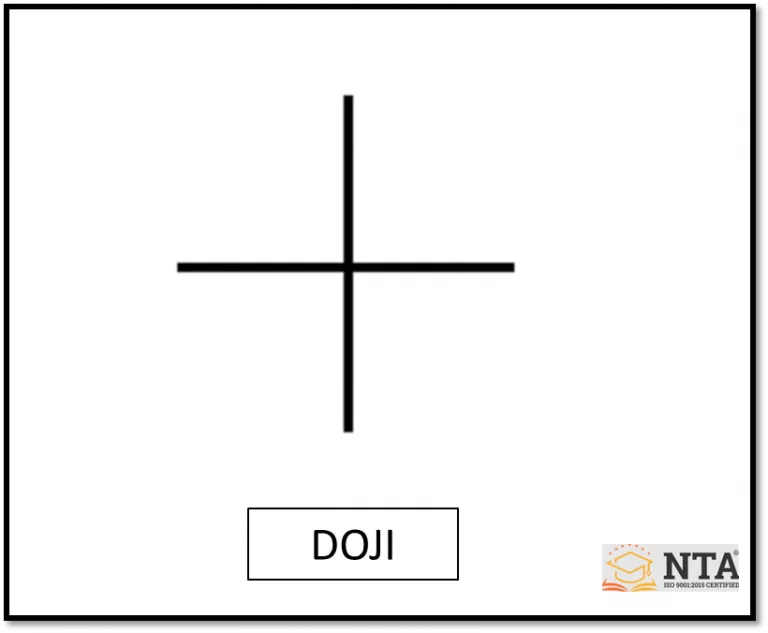

There are different types of Doji candlesticks pattern available and be aware of them. Here you can learn how to recognize it and how to convert this into profitable trading opportunities using this pattern. What is a Doji? Doji is a candlestick pattern is when the candle has the same open and closing price. Straight and cross-line with open and close level are the same and the price is high and low; Doji has nobody on the candlestick pattern but doesn’t get concerned through it whether small body or long body, it has many variations. Don’t make these mistakes when you trading the Doji candlestick pattern.

- when the price is going higher than Doji now buyers and sellers are equal and then get reverse down lower it is temporary indecision. Be aware when the Doji candlestick in an uptrend. Three types of Doji pattern are important they are:

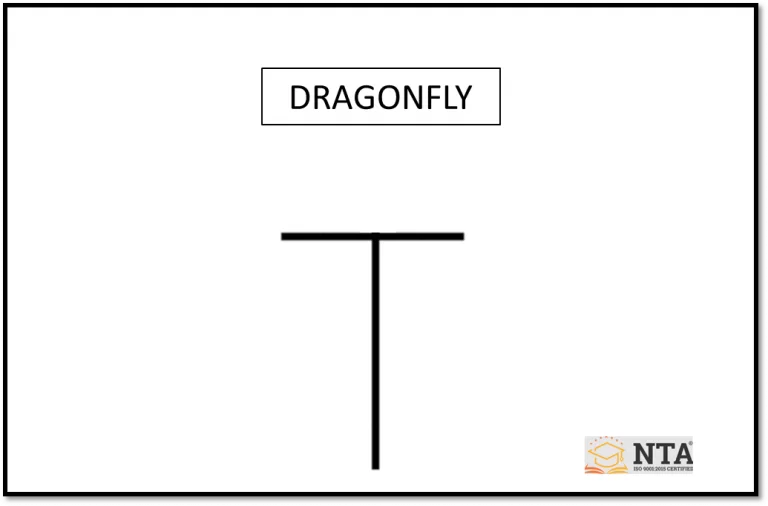

Dragonfly Doji

In Dragonfly Doji the candle has a lower wick (with the same open and close) this means rejection of lower prices. When the market opens buyers push the price down and then rise and closes the buyers pushed the price higher it is a sign of strain and don’t choose Dragonfly Doji. Isolate the Draganfly Doji pattern while trading. Always do trading by the conducts of the markets. Whatever may be the candlestick pattern you must know about the exact definition and what is the meaning behind it.

- when you have a small body and open, is slightly below the closing price and the variation Hammer at support. Give some buffer to raise high and it is a market uptrend and it is the area of value to an objective way to capture pullbacks and ride the trend.

Gravestone Doji

The candle has a upper wick with the same open and close, this means there is a rejection of higher prices. The market has rejected the highest prices. Open and close at the same level when the market opens, buyers get control and it rises and becomes up and gain come down to close it is bearish.

- To get profitable try a variation of the Gravestone Doji or shooting star

- Almost it serves as an entry trigger depending on your swing of the market appropriate.

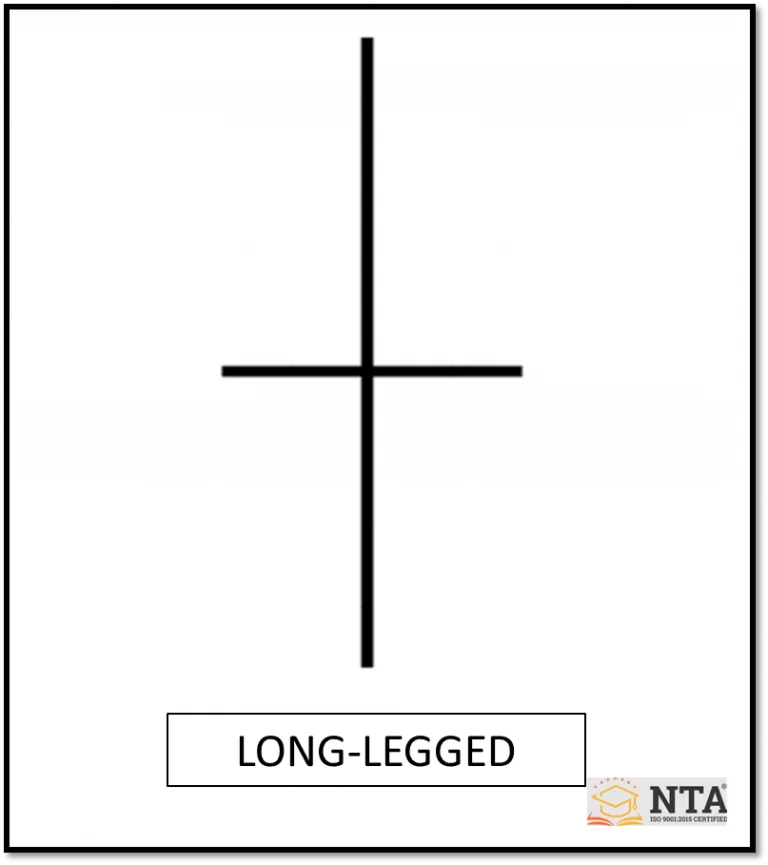

Long-legged Doji

Long-legged Doji looks like a normal candle has upper and lower wicks and it has strong indecision in the market. In the new release the price gets up and down you can see long-legged Doji can be difficult to trade because the range of the candle is worse. During the time frame don’t trade long-legged Doji. Get the opportunity to shorten the highs on the daily time frame.

Get planned and make time for your entries and exit in the market. You can use appropriate trading management and techniques to get a more profitable business in the online trading market.

By NTA®