- The story of Azim Premji is a beacon of hope as well as a reminder of the transformative power of leadership, vision, and the unwavering commitment to creating a better tomorrow for all.

- His legacy extends beyond the boardroom and is in the hearts of countless individuals who have benefited from his contributions to educational as well as social development.

- His story is the best example of how the business succeeds, along with social responsibility.

Who is Azim Premji?

- Azim Premji is a business tycoon as well as a philanthropist in India who is best known for his role as chairman and former CEO of Wipro Limited.

- Wipro is one of India’s leading multinational IT service companies.

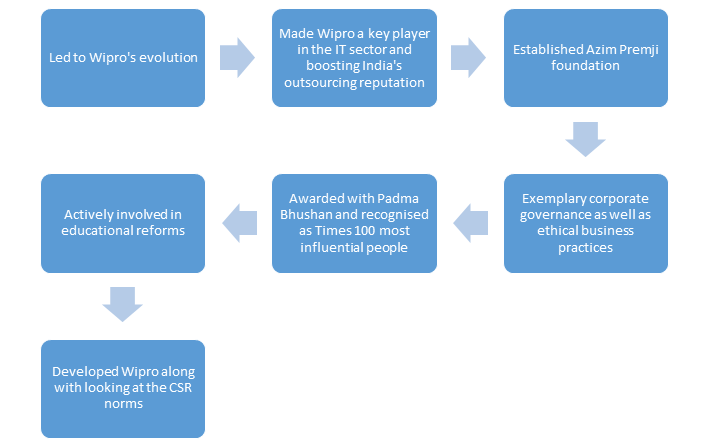

- Under Premjis leadership, the company grew from a small family-run vegetable oil company into a global IT giant.

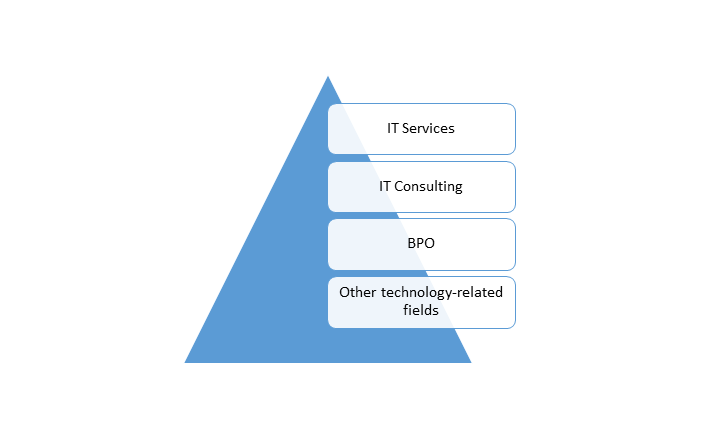

He has transformed the company into a diversified conglomerate with the following main interests:

- The company’s success has made Azim Premji one of the wealthiest individuals in India and has also earned him recognition as one of the most influential business leaders in the world.

- He is also well-known for his philanthropic efforts, as he established the Azim Premji Foundation, an NGO, in 2001 to improve the education sector in India.

- He makes significant donations to his foundation, and this has had a substantial impact on education as well as social development in India.

Highlights of his accomplishments

The key achievements of Azim Premji are as follows:

List of stocks in Azim Premji portfolio

Azim Premji does not invest in many of the stocks.

The list of Azim Premji portfolio is as follows:

Overview of Azim Premji and Associates Shareholding

Here is an overview of his investments:

Wipro Ltd

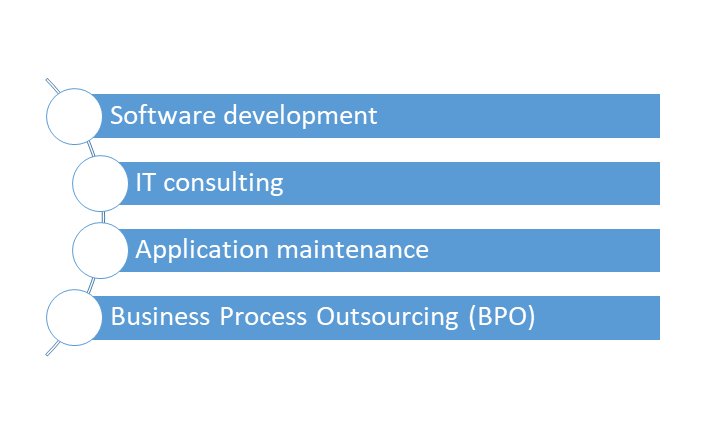

- Wipro is India leading multinational corporation, operating in the IT service as well as consulting sectors.

- Its core business is IT services.

Apart from IT, it also includes the following:

- They also tend to serve a diverse range of industries such as technology, healthcare, financial services, and much more.

- The company is known for providing IT solutions and services to its clients worldwide.

Balrampur Chini Mills Ltd

- It is a prominent company in the sugar and allied industries in India.

- The company is primarily engaged in the manufacturing of sugar.

- Its main focus is on producing white crystal sugar.

- The company operates several sugar mills in different locations.

- Apart from sugar, the company is involved in the production of ethanol, which is useful in the manufacturing of alcoholic beverages.

- It is also used as a fuel additive and in various industrial applications.

- The company tends to generate power through the co-generation process and uses its by-products from sugar production to generate electricity.

Premji and Associates portfolio: sector-wise investment

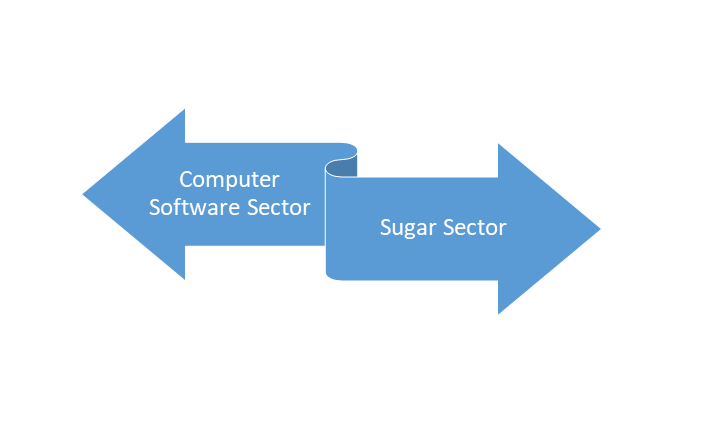

The company has majority holdings in the following two sectors:

Computer software sector

- This is the most dynamic sector.

- This is the sector specializing in software development and solutions.

- The investment in this sector will aim to capitalize on the sector's continuous evolution and its pivotal role in shaping the digital landscape globally.

Sugar sector

- This sector is deeply rooted in agriculture and food processing.

- The investment in sugar stocks encompasses companies involved in sugarcane cultivation and sugar production.

investment strategy of Azim Premji

There are many principles that underpin his investment philosophy.

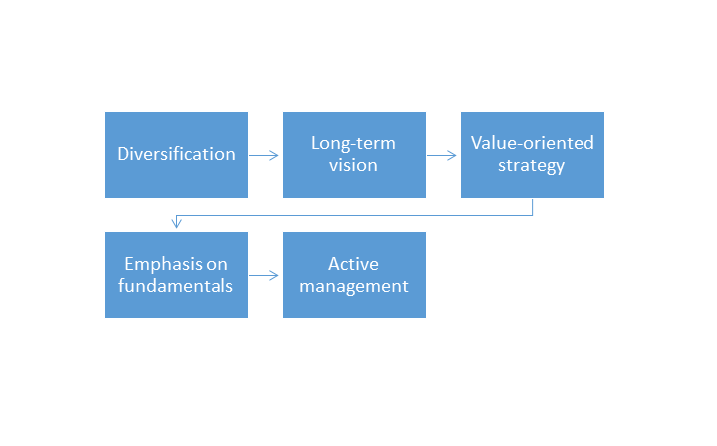

The main investment strategies of Azim Premji are as follows:

Diversification

- Premji portfolio demonstrates a commitment to diversification within his investment portfolio, which spans various sectors and asset classes.

- This will mitigate risk by avoiding overexposure to the fluctuations of any industry or asset.

Long-term vision

- Premji believes in long-term vision.

- His patient and enduring approach will involve holding assets over extended durations and enabling the potential for compounding and substantial growth over time.

Value-oriented strategy

- This methodology involves identifying undervalued assets or companies with the expectation that their intrinsic value will eventually be recognized by the broader market spectrum.

Emphasis on fundamentals

- He is into prioritizing investments in companies with solid fundamentals such as robust financials, competitive advantages, and a track record of success.

Active management

- Azim Premji plays an active role in overseeing and managing their investments.

- They are diligently conducting thorough research as well as due diligence before executing investment decisions.

Learnings from the Azim Premji portfolio

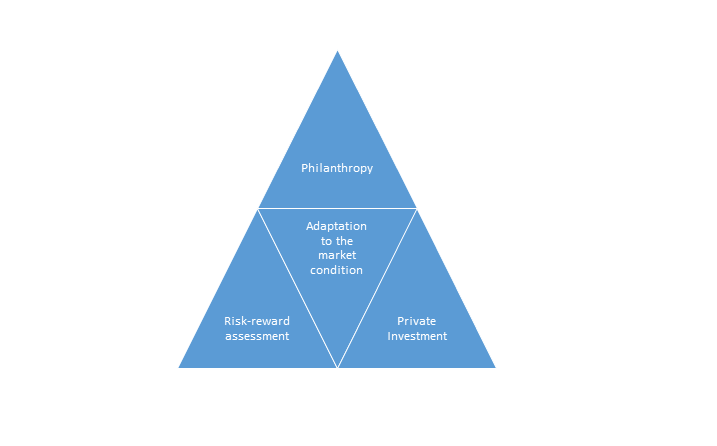

The key takeaways from the Azim Premji portfolio are as follows:

Philanthropy as a part of wealth allocation

- Premji commitment to philanthropy demonstrates that wealth is not just about making money; it is also about giving back to society.

- Investors should consider this goal in their overall wealth management strategies.

Adaptation to the market conditions

- His investment strategy tends to adapt to changing market conditions and the economic environment.

- Investors should be highly flexible and willing to adapt their portfolios in response to evolving market trends.

Risk-reward assessment

- Balancing risk and reward is always crucial.

- Premji evaluates the potential risks that are associated with the investment relative to the expected rewards.

Private investments

- Most of Premji investments are in publicly traded companies.

- His approach to investing in private companies or startups can be inspiring to those who are looking to diversify their portfolios beyond traditional assets.

Conclusion

From Wipro leading transformation into a global IT giant to his commitment to philanthropy through the Azim Premji Foundation, his journey has left an indelible mark on India and the world as a whole.

Frequently Asked Questions (FAQs)

Q1) Who is the best trader in India?

Premji and Associates is the best trader in India.

Q2) Who has the highest portfolio in India?

Mukesh Ambani and his family have the highest portfolio in India.

Q3) Who is the No. 2 trader in India?

Rakesh Jhunjhunwala is the No. 2 trader in India.

Q4) Who is the owner of Premji and Associates?

Azim Premji is the owner of Premji and Associates.

Q5) Who is the world No. 1 investor?

Warren Buffet is the world No. 1 investor.

About Us

Nifty Trading Academy is our academy where we teach about the stock market as well as technical analysis. We also provide a live market trading facility and upload blogs for the same.