- Investing in the stock market can be very complex as well as a daunting task.

- It has a lot of numerous strategies and approaches.

- Growth investing is one such strategy that has gained popularity over the years for its potential to yield substantial returns.

Understanding growth investing

- Growth investing is a strategy that focuses on identifying companies with the potential for significant growth in their earnings and, consequently, their stock price.

- Investors in growth stocks are typically looking for companies that are expected to outperform the market in terms of revenue, earnings, and other fundamental metrics.

- These companies will often reinvest their earnings into further growth by foregoing dividends to maximize the expansion.

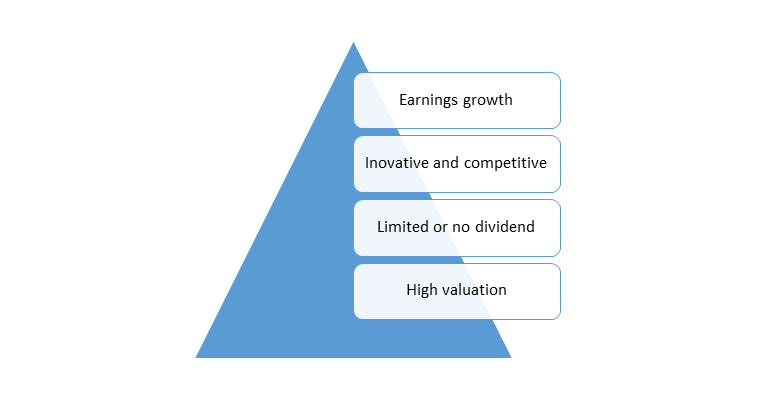

Key Characteristics Of Growth Stocks

Growth stocks also have their own characteristics

They are as follows:

Earnings growth

- Growth stocks are generally characterized by consistent and above-average earnings growth.

- Companies that are experiencing rapid growth will typically invest heavily in research, development, marketing, and other areas so as to sustain their momentum.

Innovative and competitive

- Growth companies are often innovators in their respective industries.

- They will introduce new products or services and then gain a competitive edge.

Limited or no dividends

- Unlike all the value stocks, which often distribute dividends, growth companies will reinvest their profits back into the business.

- This will help them with expansion and growth.

High valuations

- Growth stocks might have a higher price-to-earnings (P/E) ratio as compared to more mature and stable companies.

- Investors will be willing to pay a premium for the potential of future earnings.

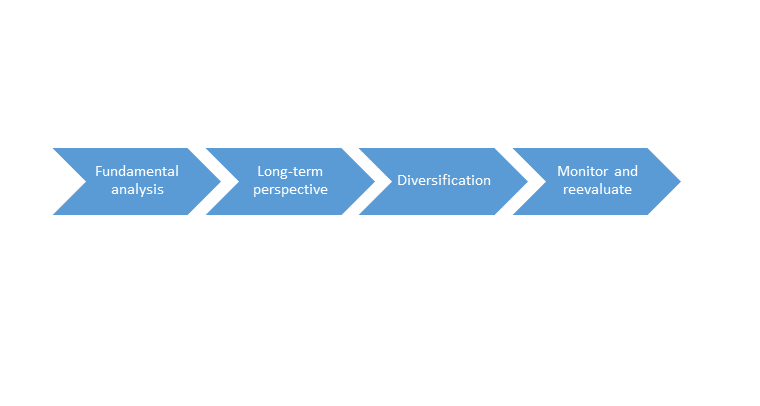

Strategies for Growth investing

Growth investing relies on various strategies.

They are as follows:

Fundamental analysis:

- You are supposed to perform a thorough analysis of the company’s financial statements, management team, industry trends, and growth potential.

- You should also assess the competitive position and growth prospects of the company.

Long-term Perspective

- Adopt a long-term investment horizon, which will also allow the investment to grow and ride out the market fluctuations.

- Growth will often take time, and all successful growth investors remain patient and committed to their goals.

Diversification

- You should diversify your portfolio so as to spread the risk across multiple growth stocks and sectors.

- This will help mitigate the impact of underperformance in any particular single investment.

Monitor and Reevaluate

- You should regularly monitor your investments and then stay updated on company developments, industry trends, and market conditions.

- Reevaluate your investment thesis and also ensure that it remains sound.

Risks And Challenges In Growth Investing

Growth investing offers several potentials, but not without risks.

The main risks and challenges are as follows:

Volatility

- Growth stocks are highly volatile.

- Due to this, they experience significant price swings in short periods due to market sentiments and expectations.

Uncertainty

- Predicting future earnings and growth can be very challenging.

- Also, there is no guarantee that a high-growth company can meet its expectations.

Valuation Risks

- Paying a high price for the growth stock can lead to severe disappointment if the growth of the company does not match the initial expectation.

Tips for success in growth investing

There are several tips for success in growth investing.

The major tips are as follows:

Research and Due Diligence

- You are supposed to conduct thorough research before you invest.

- Understand the business model of the company, market positioning, financial health, and growth prospects.

Stay informed

- You should keep yourself updated with the latest market trends, economic developments, and changes in the industry landscape.

- This will also impact your investments.

Risk Management

- Set clear tolerance levels and then adhere to them.

- You are not supposed to invest more than what you can afford to lose.

Continuous learning

- Keep learning and improving your understanding of growth investing as and whenever required.

- Markets will evolve, so you need to stay informed, as this is the most crucial step.

Frequently Asked Questions (FAQs):

Q1) What is the easiest way to grow in the stock market?

By diversifying your portfolio, you can grow easily in the stock market.

Q2) What is the best way to value growth stocks?

The best way to value growth stocks is to use the PEG ratio.

Q3) What are the three good stocks to invest in?

The three good stocks to invest in are GE Aerospace, Iron Mountain Inc., and Axon Enterprise Inc.

Q4) Which stock is growing very fast?

Bajaj Holdings is growing very fast.

Q5) What is the best formula for picking stocks?

The P/E ratio is the best formula to pick stocks.

About Us

Nifty Trading Academy is our academy, where we teach you about the stock market as well as technical analysis. We also provide live trade sessions and upload blogs for them.