- The fluctuating stock prices will make equity investments risky.

- All the risk-averse investors prefer to stay away from the stock market.

- However, the risk-takers will invest aggressively in the stock market.

- The nature of the stock market is dynamic, but why it is dynamic is something no one knows.

- There are some factors that make the stock market dynamic.

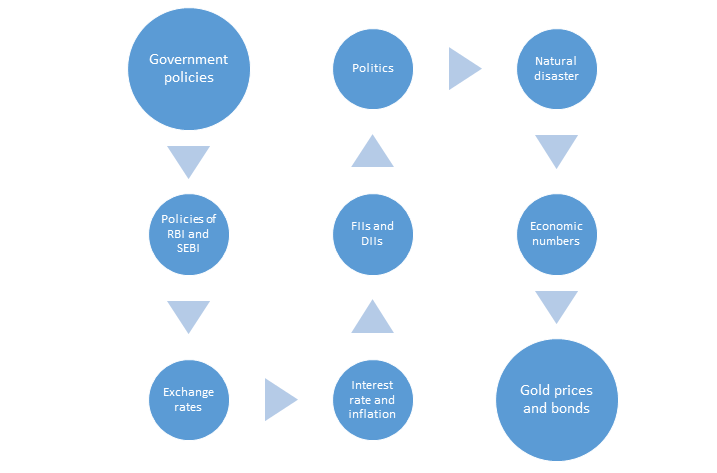

Factors that affect the stock market

The dynamic nature of the stock market is due to several factors.

They are as follows:

Government policies

- The economy and businesses are largely affected by government policies.

- The government has to implement the policies with regard to the economic condition of the country.

- Any change in policy can either be profitable or tighten the economy.

- This will cause the stock market to be affected by any change or the introduction of any new policy by the government.

Monetary policy of the RBI and regulatory policy of SEBI

- The RBI is the apex body that regulates the monetary policy of India.

- It will keep reviewing the monetary policy.

- Any increase or decrease in the repo or reverse rate will impact the prices of the stock market.

- If the RBI increases the key rate, then the liquidity in the bank will reduce.

- Investors will see this as a barrier to the expansion of business activities and will then start selling the shares of the company, which will reduce the stock price in general.

- A reverse will happen when the RBI follows dovish monetary policy.

- When the banks reduce the lending rate, it will lead to credit expansion.

- Investors will see this as a green flag, and so stock prices will start increasing.

- Any changes in the trading and investment policy of SEBI will impact the performance of the shares that are listed on the stock exchange.

Exchange rates

- The exchange rate of the Indian currency will keep fluctuating with other currencies.

- When the rupee strengthens with respect to other countries, it will cause Indian goods to become more expensive in those countries.

- Companies that will be affected here are those that are involved in overseas operations.

- And the companies that are dependent on exports will experience a drop in demand for their goods abroad.

- Due to this, the revenue from exports will decline, and the stock prices of such companies in the home country will fall.

- On the other hand, softening the rupee with other currencies will result in the opposite effect.

- In this scenario, the stock price of the exporter will rise while that of the importer will fall.

Interest rate and inflation

- Whenever the interest rate goes up, banks will raise their lending rates, which will increase the cost for corporations and individuals alike.

- This rising cost will tend to have an impact on the profit levels of the business, which in turn will affect the stock price of the company.

- Inflation is nothing but a surge in the price of goods and services over a period of time.

- High inflation will discourage investment as well as long-term economic growth.

- These listed companies in the stock market might also postpone their investments and halt production.

- This will lead to negative economic growth.

- The fall in the value of money will lead to a fall in the value of savings.

- The stock of the luxurious companies will also suffer, as nobody will wish to invest in them.

- This will affect not only the purchasing power but also the investing power to a very great extent.

Foreign Institutional Investors (FIIs) or Domestic Institutional Investors (DIIs)

- All the FII and DII activities will highly impact the stock market.

- They also have a prominent role in the stocks of the company, and hence their entry and exit will create a huge impact on the equity market and will in turn influence the stock market.

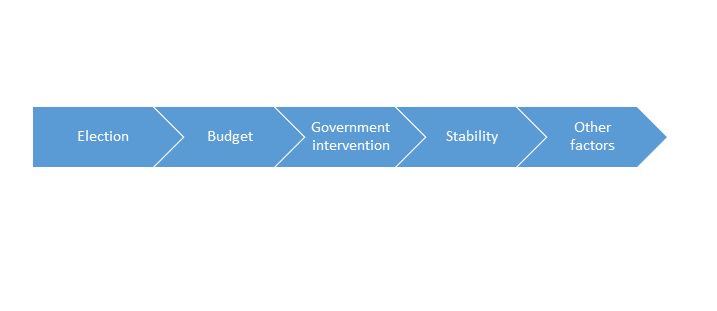

Politics

- There are many factors that have a huge impact on the economy and the financial markets.

They are as follows:

- The political events as well as budget announcements will create a tremendous level of volatility in the market and will thereby deeply influence the stock market.

Natural disasters

- Natural disasters hamper lives and the market equally.

- It will impact the performance of the company and the capacity of the people to spend money.

- This will lead to lower levels of consumption, lower revenue, and lower sales, which will ultimately impact the stock performance of the company.

Economic numbers

- Various economic indicators will affect the overall economy, which in turn will have an impact on the financial market.

- The sudden movement of oil prices as well as GDP will have a huge impact on the stock market.

- The movement of oil prices plays a key role in the stock market price fluctuation.

- GDP also looks at aspects of the total economic production of the country as well as its overall economic health.

- This will help to showcase the economic developments and the future direction of the market.

- A healthy GDP will have a positive impact on the financial markets as well as investments.

Gold prices and bonds

- There is no hidden theory that states that there is a relationship between stock prices, gold, and bonds.

- Stocks are considered to be a risky investment, whereas investments in gold and bonds are considered to be safer investments.

- So during any major crisis in the economy, investors will prefer to invest in safe options.

- Hence, when the gold and bond prices increase, the stock price will tumble.

Conclusion

Stock prices in the country may rise or fall due to several factors.

Frequently Asked Questions (FAQs)

Q1) What actually affects the stock price?

Supply and demand will affect the stock price to a great extent.

Q2) Who decides the stock price?

Once the company goes public and its shares start trading on the stock exchange, its share price will be determined by supply and demand in the market.

Q3) What is a new issue in the stock market?

A new issue arises when companies issue new securities to the public for the very first time.

Q4) Who runs the share market?

SEBI is the main regulator of the stock market in India.

Q5) What is the riskiest type of stock?

Equities are considered to be the most risky class of assets.

About Us

Nifty Trading Academy is our academy, where we provide knowledge about the stock market as well as technical analysis. We also provide live market training and upload blogs for it.