- The stock market is a dynamic world.

- Here, prices are influenced by several myriad factors, and due to this, mispriced stocks will present a unique opportunity for some real investors.

What are mispriced stocks?

- Mispricing will occur when the market value of the stock deviates from its intrinsic value.

- This will create the potential for significant gains.

- These stocks are the most attractive options for savvy investors.

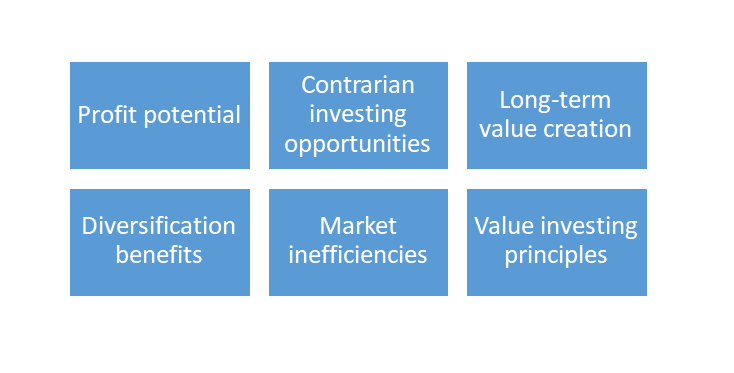

Benefits of investing in mispriced stocks

There are several benefits to investing in mispriced stocks.

They are as follows:

Profit potential

- Investing in mispriced stocks will offer a unique opportunity to exploit the old adage of “buy low, sell high.”

- When the stock is undervalued, this means that the market has temporarily overlooked its true value.

- Savvy investors will capitalize on this by acquiring these stocks at a huge discounted price.

- When the market recognizes the intrinsic worth of the stock, its price will also correct, which will also provide investors with the potential for substantial profits.

Contrarian investing opportunities

- Mispriced stocks will often find themselves in the midst of adversity, either due to short-term challenges faced by the company or the negative sentiment prevailing in the market.

- Contrarian investors will look for such opportunities and will seek out undervalued stocks that may be temporarily out of favor.

- Contrarian investors will also position themselves to benefit when the market corrects its perception, which will lead to a potential surge in stock prices.

Long-term value creation

- For investors with a long-term perspective, mispriced stocks can serve as the cornerstone of a wealth-building strategy.

- When you evaluate the fundamentals of undervalued stocks, investors will be able to identify companies with strong growth potential and solid financial health.

- This patient approach to holding onto the assets will allow the investors to ride out short-term market fluctuations and also capitalize on the gradual appreciation of the stock’s value as the market aligns with its true worth.

Diversification benefits

- Integrating all the mispriced stocks into the diversified portfolio will offer a wide range of benefits.

- As the prices of these stocks may not be in line with broader market trends, they might introduce a level of independence to the portfolio.

- This lack of correlation will reduce the overall risk and volatility of the portfolio, which will also provide a buffer against market downturns.

- Diversification with mispriced stocks can be a strategic move so as to enhance the risk-adjusted returns and also increase the resilience of the overall investment strategy.

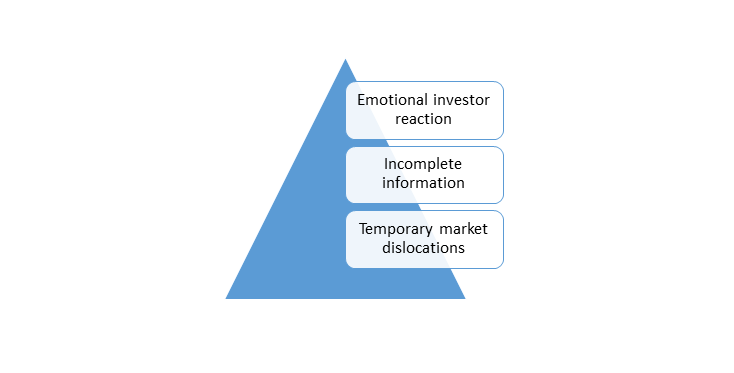

Market inefficiencies

Markets are imperfect, so mispricing will emerge.

Mispricing will emerge due to various factors, such as the following:

- Diligent investors who engage themselves in thorough analysis and research will have the potential to identify these inefficiencies before they are even corrected by the broader market.

- This approach will allow the investors to position themselves advantageously while seizing opportunities for profit before the market fully adjusts.

Value investing principles

- Mispriced stocks will align closely with the time-tested principles of value investing.

- This approach was popularized by the legendary investor Warren Buffet.

- He emphasizes the importance of identifying stocks that are trading below their intrinsic value.

- While focusing on a margin of safety, value investors will aim to protect themselves from potential downside risks while they are positioning for long-term growth.

- Mispriced stocks tend to provide fertile ground for applying these principles, which allows investors to build a resilient portfolio that can weather market fluctuations with great stability.

Conclusion

Investing in mispriced stocks is not without risks, and thorough research and analysis are crucial before making any investment decision.

Frequently Asked Questions (FAQs)

Q1) What happens when a stock is mispriced?

Mispricing occurs when the market value of the stock deviates from its intrinsic value, thereby creating a potential for significant gains.

Q2) Is buying undervalued stocks a good strategy?

It can be a profitable strategy for traders who are willing to do their research and also take a long-term approach.

Q3) How do you identify mispriced stocks?

Technical analysis will help identify the mispriced stocks.

Q4) Is it a good idea to hold undervalued stocks?

Undervalued stocks will often come with a margin of safety, which will reduce the downside risk for investors.

Q5) What is a mispriced stock?

It refers to the situation when the actual value of an asset or product will differ significantly from its perceived value or the market price.

About Us

Nifty Trading Academy is our academy, where we teach you about the stock market as well as technical analysis. We also deliver live trading sessions and upload blogs for them.